“It is rare to see a professional economist, in interpreting the past or forecasting the future, quoting what a businessperson or newspaper writer thinks is going on, let alone what a taxi driver thinks. But to understand a complex economy, we have to take into account many conflicting popular narratives and ideas relevant to economic decisions, whether the ideas are valid or fallacious.”

- Robert J. Shiller, Narrative Economics: How Stories Go Viral and Drive Major Economic Events

In late 1929, two weeks before the most catastrophic stockmarket crash in US history, Professor Irvin Fisher, one of the most respected economists in the United States, assured investors that stock prices had reached “what looks like a permanently high plateau”. The esteemed Yale economist suggested that in a matter of months the stockmarket should be “a good deal higher than it is today”. Instead, only a few weeks later, the Dow Jones Industrial Average had lost some 50 per cent of its value.

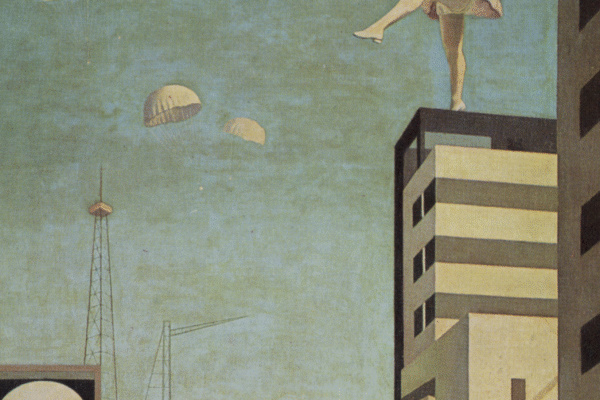

The assumption that ‘things are different now’ is one that ordinarily accompanies stockmarket bubbles. New technology drives a ‘new normal’ that is reflected in elevated share prices, or so investors are led to believe. In the 1920s, technological advancements in the automotive, radio broadcasting, electricity, consumer goods, and aviation industries led to widespread speculation in the stockmarket. By late 1929, dinner table conversation was rife with stories of fortunes made on stocks that exploited this ‘new norm’.

The current Artificial Intelligence (AI) boom is no different. Andrew Ng, the co-founder of Google Brain, called AI the “new electricity”, while Sundar Pichai, the CEO of Alphabet, declared: “AI is one of the most important things humanity is working on. It is more profound than, I dunno, electricity or fire.” In recent years, the AI narrative has fuelled investor excitement, sending the S&P 500, the US major index, to record highs. It resembles the euphoria associated with the dot-com era in the late 1990s and early 2000s, when stocks with anything internet-related floated to glorious heights. ‘New economy stocks’ were touted as the leaders of the future while ‘old economy stocks’ were left to adapt or die.

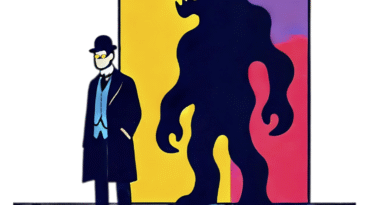

In his book, Narrative Economics: How Stories Go Viral & Drive Major Economic Events, economist Robert J. Shiller discusses how popular narratives spread, much like a contagious disease. The hype surrounding AI and the cryptocurrency Bitcoin are examples of successful economic narratives (“People are interested in Bitcoin precisely because so many other people are interested in Bitcoin”, writes Shiller). When narrative epidemics catch on, they can fling prices into the stratosphere, as happened to Bitcoin, which surged almost 40 per cent in less than twenty four hours in 2019. British economist John Maynard Keynes labelled it “animal spirits” – the instincts and emotions that drive human behaviour.

Shiller, who was awarded the Nobel Prize in Economics, argues that economists are too often buried in economic modelling to notice the wild weather patterns of economic narratives. But he thinks they’d be well advised to start incorporating these ‘animal spirits’ and their associated effects into forecasting models. “The study of the viral spread of popular narratives that affect economic behaviour, can improve our ability to anticipate and prepare for economic events,” he concludes.